[ad_1]

Not to be confused with the Midas touch, the gold standard is a basis for gauging the value of currency, and it played a critical role in the establishment of the U.S. dollar. The nation steadily veered further and further from a true gold standard, and today the U.S. dollar is truly fiat in nature — not backed by any intrinsically valuable commodity.

Yet we still see misconceptions about the state of the gold standard. For instance, 29% of respondents in our recent study How Well Do Americans Know Money? 2019 believe that the U.S. dollar is still backed by gold. The public deserves some conclusive answers about the state of the gold standard, how it came to be, why it was valuable, and why we ultimately did away with it. Lucky for you, we have those answers right here.

What is the gold standard?

The gold standard is a measure of value for a nation’s currency that is based upon the amount of gold that nation holds in its reserves. The idea becomes more tangible when presented as an example: if Tim or Jane holds fifty paper dollars from any nation, they should be able to swap those dollars out for a certain amount of gold based on a defined exchange rate. That’s the idea, at least.

The amount of gold that one would receive in exchange for their dollar is often referred to as the “par value”. Whether you were to be exchanging a franc, pound, euro, or dollar for gold, the par value would determine how much gold you’d receive in return.

So, the concept of a gold standard isn’t too complicated, at least on the surface level. What is less clear is how the gold standard came to be, and how most of the world eventually broke from the gold standard as a tangible measure of value.

What is the history of the gold standard?

Greek historian Herodotus wrote of what we believe to be the earliest use of gold as currency. He pointed to the use of gold coins by the Lydians, who resided in the region that is modern-day Turkey, during the fifth century. These coins arguably represent the earliest use of a gold standard, albeit one that was more directly tied to gold (the currency itself was at least partially comprised of gold) than the gold standard Americans and others would come to know centuries later.

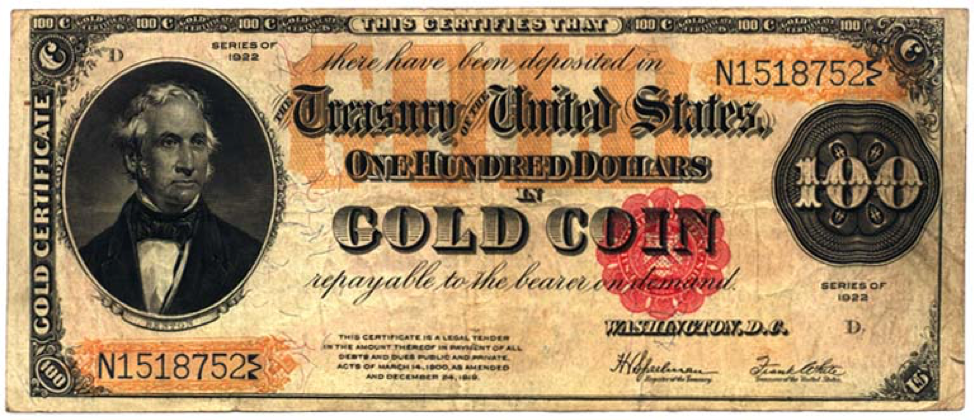

We can trace the roots of the American gold standard to the discovery of gold in California in January 1848. This discovery precipitated the Gold Rush, and America’s newfound abundance of the valuable precious metal would lead President McKinley to sign the Gold Standard Act in March of 1900.

Source: americanbullion.com

The Gold Standard Act set the price of gold at $20.67 per ounce, and the value of each dollar at 25.8 grains of gold. This put an end to long-held debates over whether gold or silver was preferable as a store of value — fans of silver would simply have to deal with this new reality. It would turn out that they wouldn’t have to deal with it forever, though.

As worsening economic conditions leading up to the Great Depression caused the stock market crash of 1929 and banks to increasingly fail, Americans began to hoard gold. One economic tool for stimulating the economy — increasing the money supply — became impossible, as the amount of money was directly tied to the amount of gold in government reserves, and citizens were wary of selling their gold to the government or anybody else.

Credit: Bettmann Archive/Getty Images

This led the administration of Franklin D. Roosevelt to follow England’s lead, signing the Gold Reserve Act in 1934. This made it illegal for American citizens to own most forms of gold, in doing so requiring them to turn their gold coins over to the Treasury at a set price of $20.67 per ounce.

This seemingly helped stimulate the economy, but many have argued its long-term effects remain primarily detrimental. The final nail in the American gold standard’s coffin came in 1971, when President Richard Nixon ended the ability to exchange dollars for a fixed amount of gold, and in doing so upended the fixed nature of international currency. Prior to 1971, the Bretton Woods System tied most international currencies to the dollar, which was tied directly to gold.

This was no longer the case post-1971, and while the cessation of the gold standard initially halted inflation and a run on gold, it would have far-reaching effects, many of them negative.

What are the advantages of the gold standard?

World War I served as an early and a prime example of the value of tying paper currency’s value to something of tangible value, in this case gold. In the face of massive wartime costs, several European nations abandoned the gold standard, allowing those nations to print as much money as necessary to pay the high cost of war.

However, this ultimately led to massive hyperinflation, as the value of paper money lessened as it saturated the marketplace and consumers (and the government) lost confidence in the real value and purchasing power of paper money. The reality of hyperinflation is common when any nation moves away from a real basis of value, such as gold, as an anchor for its paper currency.

Herein lies the value of the gold standard: paper money is worth a defined amount, and that paper money can be exchanged at any time for the item of real value that backs the paper currency, in this case gold. This tends to stabilize the real value of money as well as consumers’ confidence in the value of that money.

As we’ve seen, abandoning the gold standard can cause a funny money effect that can ultimately causes worldwide inflation and degrade the sense of true, definable value that paper money is supposed to have.

What are the disadvantages of the gold standard?

History illustrates that the primary disadvantage of the gold standard is the inability of a government to manipulate the money supply in tough economic times. When signs of trouble arise, the public tends to exchange their paper money for gold, preferring the item with inherent value versus paper money, which is only theoretically linked to the item of inherent value.

This understandable human inclination to hoard gold only exacerbates a contracting economy, and the government’s inability to purchase gold from the people in exchange for paper money only lessens the perceived value of that paper money. Put yourself in the government’s shoes: how could you allow the people to hoard all of the gold, and thus the element that imparts value on a nation’s paper money?

The answer: you can’t allow this, and therefore we get The Gold Standard Act of 1933 and Nixon’s outlawing of paper money’s exchangeability for gold in 1971. With these acts, America and the world kissed the gold standard goodbye, with little likelihood of a future return.

Download our Free 13 page Exclusive Report:

The Perceptions of Money & Banking in the US 2019

[ad_2]

Source link