[ad_1]

When was the last time you heard mention of any central bank? During the lesson on Alexander Hamilton in your eighth grade American History class? You’re probably not alone.

Actually, you’re definitely not alone: nearly 50% of respondents in our recent study of 1,000 US consumers stated that they did not know what the federal reserve — the central bank of the United States — does.

Though the topic of central banks doesn’t arise frequently in most people’s daily conversations, these financial institutions play a critical role in America’s financial structure and, by extension, the global economy.

We’ve answered a few basic questions that should broaden your knowledge of how central banks work, how they were started, and how they impact your life.

What is a central bank?

Source: Market Business News

Central banks are the kings of any national banking system, regardless of their country of origin. Their goal, above all else: to ensure the stability and long-term health of a nation’s financial systems. Heads of central banks aim to achieve this lofty goal through several tacts.

First, they typically serve as a bank to other banks, serving the same functions that your bank offers to you, only at a substantially larger scale. Banks store money with a central bank — lots of it, in most cases — withdrawing funds when their coffers are low and depositing when they are flush. A central bank may also provide smaller banks with emergency funds in times of low liquidity, such as a micro-bank run.

A central bank may also play a role in setting bank requirements, such as the percentage of deposits that a given bank must keep in its reserves. In this way, central banks can impact the money supply and implement changes in monetary policy, which usually happens in response to inflation and other economic trends.

These central banks — the federal reserve being a prime example — are designed to be independent as to avoid conflicts of political interest.

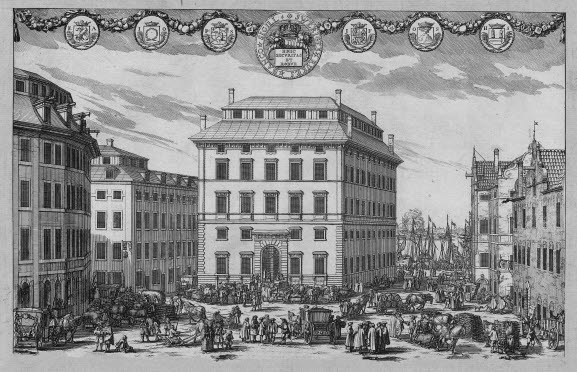

What’s the history of central banks?

Source: RiksBank

Sweden is thought to have created the first central bank on record, the Riksbank, in 1668. This was the first in what would prove to be a trend of banks establishing a national banking infrastructure headed by a central bank.

We can trace the history of central banks in America back to the wake of the American Revolution. The post-Revolution United States found itself saddled with debt, and initially each state was on the hook for varying amounts of debt. The obvious problem: those states had no clear path to repayment, and even if they did, most states printed their own currency and relative value was nearly impossible to figure.

So Alexander Hamilton floated the idea of a national central bank that would take over the wartime debts of the states, create a unifying national currency, and set a clear course to solvency.

This concept led to the creation of The First Bank of the United States in 1790-1, located in Philadelphia. The bank raised $10 million by selling stock, owned partially by the federal government and private investors. Eventually, the First Bank and its successors would take on commercial functions that would serve as groundwork for our central banking system of today.

In 1816, Congress chartered the Second Bank of the United States, which would serve similar functions as the First Bank until its charter was vetoed in 1836 by President Andrew Jackson. The Second Bank would also serve as a clearinghouse for smaller banks, holding their notes in reserves and regulating those banks that were perceived to be over-issuing bank notes.

We now view these initial forays into national banking as the roots of the central banking system we know today, with the federal reserve at the top of the banking food chain in America. Central banking has also become a global phenomenon.

What do central banks do exactly?

Central banks serve as number of functions, from safeguarding the majority of a nation’s money supply to directly altering monetary policy and the supply of money in circulation. We’ve talked about how a central bank serves as the bank for smaller banks by storing their funds and facilitating deposits and withdrawals. This is far from a central bank’s only function.

In the case of a financial emergency, the central bank is often expected to bail out smaller banks, adjust interest rates to offset damaging economic trends and events, and in doing so, prevent a domino effect of bankruptcies among the smaller banks that the central bank serves.

The central bank’s oversight and manipulation of the money supply is also critical to a nation’s overall financial health. During economic slowdowns, the central bank can buy bonds and other securities in exchange for cash, putting more money into circulation in hopes of stimulating economic activity. In times where the economy is showing signs of alarming hyperactivity, a central bank can sell bonds for cash, decreasing the money supply in hopes of reaching a more sustainable economic rate of growth.

Central banks may also set interest rates among its member banks, with these rates going a long way towards determining how freely those member banks extend loans and, by extension, how much money is in circulation. The central bank typically provides basic payment services, such as providing credit and facilitating Social Security payments — two important services within an economic system.

Does every country have a central bank?

The majority of nations have a central bank of some sort, though the integrity and effectiveness of these central banks can vary greatly from nation to nation. As of 2019, only nine sovereign, internationally-recognized nations are without a central bank. Each of them has a population of less than 120,000 people. They are Kiribati, Micronesia, Isle of Man, Andorra, Marshall Islands, Monaco, Palau, Tuvalu, and Nauru.

Who owns central banks?

Central banks are intended to be independent as to avoid corruption and political influence, but this is not always the case. In Socialist and Communist nations, for example, it’s often the case that the government has direct oversight of the central bank and essentially uses it as its personal piggy bank.

But in most developed, economically healthy nations, the government does not venture beyond appointing central bank leadership. This is the case in the United States and most other developed nations without cultures of institutional corruption.

Download our Free 13 page Exclusive Report:

The Perceptions of Money & Banking in the US 2019

[ad_2]

Source link