[ad_1]

It’s not the first time that the native token of the Avalanche blockchain has encountered wild fluctuations. In February, AVAX shot as high as $60 only to reach a nadir in June–July. But after bottoming at $9.34, AVAX is now beyond $60 and is currently trading at $76. This has earned it a spot in the top 20 cryptocurrencies by market capitalization with $16 billion, according to Cointelegraph Markets Pro. Avalanche is among the layer-one blockchains tagged as “Ethereum killers” that appear to have reduced the dominance of the top altcoin in terms of total locked value (TVL) lately. Of the $170 billion in TVL, Ethereum presently controls 67% based on data from Defi Llama. But while the number appears high, it’s actually much lower than February when it contained about 96% in TVL.

Background on Avalanche

Avalanche was developed by Cornell computer science associate professor Emin Gün Sirer and Ava Labs in 2018. The blockchain protocol boasts high throughputs and a swift finality time. In 2019, it received initial funding through the sale of 18 million AVAX tokens priced at $0.33 each, which amounted to nearly $6 million. The following year, an additional 24.9 million tokens were auctioned in a private sale, this time at $0.50 each, bringing in an extra $12 million in funding. In July 2020, Avalanche secured another $42 million through a public token sale. And on Sept. 16, 2021, Avalanche’s most recent funding bagged $230 million from various investors led by Polychain and Three Arrows Capital. This brings a total funding amount of $290 million for Avalanche despite its mainnet launch just celebrating its first anniversary.

How is Avalanche reimagining DeFi?

Avalanche is caught in the midst of intensifying layer-one competition, with the likes of Binance Smart Chain (BSC), Polkadot and Terra vying for a larger market share from their main competitor, Ethereum. And much like its counterparts, scalability for Avalanche is similarly crucial. Avalanche boasts 4,500 transactions per second (TPS) with less than a three-second finality. In contrast, Ethereum processes 15–30 transactions per second with over 1-minute finality. Moreover, transaction fees are a lot more desirable on Avalanche compared to Ethereum. Avalanche’s fees range from 75 nAVAX up to 225 nAVAX ($0.0000048 to $0.0000144 at the coin’s present value).

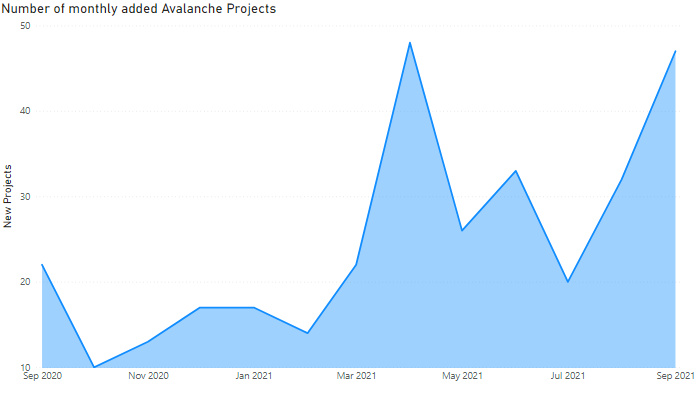

However, it takes more than lower costs and faster transactions to compete with the first-mover in Etheruem. Developers willing to build applications on Avalanche are necessary to foster adoption. In this regard, it’s clear how Ethereum has the upper hand with 2,585 listed decentralized applications (DApps). But despite it being only a year old in existence, Avalanche already has attracted 320 projects.

Source: Avax-Projects

Projects such as SushiSwap, Chainlink, Circle and The Graph have benefited from the smart contract infrastructure provided by Avalanche. Nonfungible tokens, or NFTs, have also found a home on Avalanche; for example, Topps, a sports-themed trading card company, has minted a Major League Baseball NFT collection on Avalanche called “Inception.” Topps has also partnered with the German football league Bundesliga, releasing video moments from the league in two available card packages — all as NFTs on the Avalanche blockchain. What’s more, the $230 million raised by Avalanche in 2021 will be earmarked to support this flourishing decentralized finance, or DeFi, ecosystem.

Ethereum Bridge

One of the significant steps that Avalanche has undertaken in redefining finance is its cross-chain Ethereum bridge, wherein it facilitates “seamless ERC-20 and ERC-721 transfers between Avalanche and Ethereum.” The bridge helps migrate Ethereum’s DeFi infrastructure to Avalanche, allowing users to conduct faster and cheaper transactions.

Pangolin, a notable player in the DeFi space, is built on Avalanche and benefits from the Avalanche–Ethereum bridge. The decentralized exchange (DEX) enables trading of all tokens issued on Ethereum and Avalanche. This enables users to circumvent the high and sluggish transaction times in swapping assets. Apart from Pangolin, other DApps, such as bZx, Union, JellySwap, Prosper, e-Money and others, have joined the Avalanche ecosystem.

So far, a total of $1.72 billion in assets have been transferred using the bridge.

More DeFi growth

Also, in a move to further its burgeoning DeFi ecosystem, Avalanche is bringing on board two of the leading DApps on Ethereum to the Avalanche blockchain. Avalanche Rush, a $180-million liquidity mining incentive program, was partially distributed to Curve Finance and Aave. In the program’s initial phase, AVAX will be used as liquidity incentives for Aave and Curve users over three months. About $27 million worth of AVAX has already been set aside by the Avalanche Foundation to fund the program, and there are also additional allocations planned for its second phase.

In addition to Aave and Curve Finance, Pangolin also joined Avalanche Rush, supplying $2 million in AVAX incentives for a single-sided pool of Pangolin (PNG).

What’s under the hood?

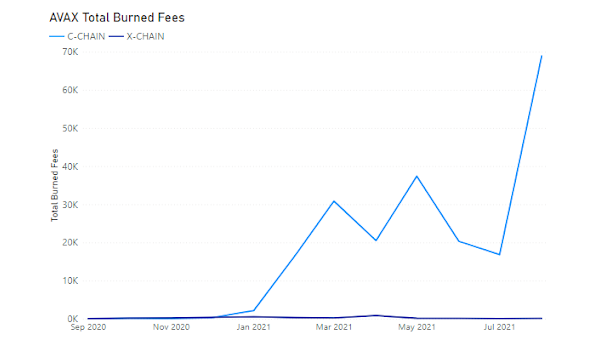

Perhaps Avalanche’s strongest suit is its network infrastructure, which is touted to provide better decentralization. Avalanche is composed of three integrated blockchains: The Exchange Chain (X-Chain), Platform Chain (P-Chain) and Contract Chain (C-Chain). The X-Chain is primarily for creating and exchanging assets, while the P-Chain is for creating subnets and coordinating validators, and the C-Chain is for executing Ethereum Virtual Machine contracts. Most of the transactions take place in the C-Chain as Ethereum developers can easily build Ethereum-compatible applications using this blockchain.

The three blockchains are validated and secured by a its main network, which is a special type of subnetwork or subnet. Anyone can secure the network by staking at least 2,000 AVAX, currently $152,000. Avalanche defines a subnet as a “dynamic set of validators working together to achieve consensus on the state of a set of blockchains.” Essentially, a subnet is a new network capable of hosting multiple blockchains that can have its own consensus model and its own virtual machine.

These subnets open up opportunities for certain niche use cases as they are highly customizable. This can be useful for different organizations, companies and even governments because the network’s architecture also supports private subnets, meaning that those who want to deploy private blockchains can do so.

Why has the price of AVAX spiked lately?

Avalanche Rush was a major factor that contributed to the price of AVAX jumping by 192% in August. But another reason why the price of AVAX appreciated recently is due to more upcoming initial DEX offerings (IDO). AvaXlauncher, the launchpad and incubator for the Avalanche ecosystem, has announced two new IDOs on Twitter. One is Oracle on Avalanche, and the other is Gaming Project: Breed, Play and Earn.

And with those two IDOs, stakers and holders of AvaXlauncher (AVXL) tokens will get airdropped a small portion of those IDOs. An IDO is a new type of crowdfunding model in the crypto space. It offers immediate liquidity, immediate trading and lower costs for listing compared to anteceding models such as initial coin offerings and initial exchange offerings.

Download the 31st issue of Cointelegraph Consulting Bi-weekly Newsletter in full, complete with charts and market signals, as well as news and overviews of fundraising events.

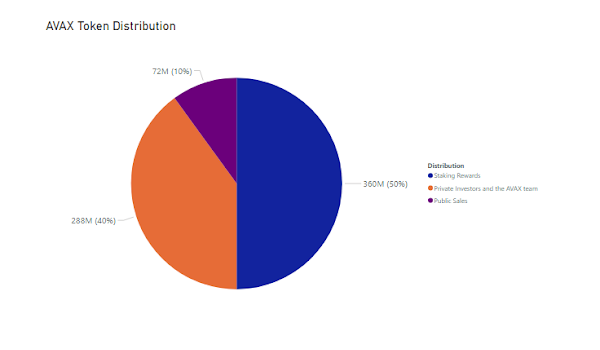

Factoring the tokenomics

The tokenomics behind AVAX may also play a small role in its increasing value. There is a cap on token supply at 720 million AVAX, but it’s worth noting that 40% of it is already allocated to private investors and the AVAX team. Then, about 360 million is allotted for staking rewards, and 10% went to public sales.

Source: Avalanche

Moreover, the fees for each transaction also follow a similar burning mechanism akin to Ethereum Improvement Proposal 1559. To date, nearly 278,000 AVAX tokens ($21 million) have been burned since its inception, placing further deflationary pressures in addition to its limited supply. At present, the total circulating supply of AVAX is around 220 million AVAX.

Source: Avascan

There is no doubt that the growing popularity of layer-one protocols is reimagining the DeFi landscape. But even with Ethereum’s dominance tapering slightly, as evidenced by its reduced TVL, it remains in an enviable spot that competitors may find hard to uproot. So, to count out Ethereum before Ethereum 2.0 could be premature. Still, these “Ethereum killers” are on the rise, and sooner or later, one may emerge as a worthy adversary.

Cointelegraph’s Market Insights Newsletter shares our knowledge on the fundamentals that move the digital asset market. The newsletter dives into the latest data on social media sentiment, on-chain metrics, and derivatives.

We also review the industry’s most important news, including mergers and acquisitions, changes in the regulatory landscape, and enterprise blockchain integrations. Sign up now to be the first to receive these insights. All past editions of Market Insights are also available on Cointelegraph.com.

[ad_2]

Source link