[ad_1]

The publicly listed company Microstrategy announced that it has plans to purchase more bitcoin after acquiring 71,079 bitcoin during the last six months. On Tuesday, Microstrategy revealed its plans to sell $600 million in convertible senior notes to qualified institutional buyers in order to use the funds for bitcoin.

Selling Convertible Notes for Bitcoin

At around 7:59 a.m. (EST) on Tuesday morning, Microstrategy (Nasdaq: MSTR) CEO, Michael Saylor tweeted about a new private sale his firm is committing to in order to sell $600 million in convertible senior notes. Microstrategy’s announcement says that the notes will be unsecured, senior obligations of Microstrategy, and will bear interest semi-annually to holders. The notes will mature on February 15, 2027, and Microstrategy says that the firm can redeem cash for all the notes sold.

The announcement further reads:

Microstrategy intends to use the net proceeds from the sale of the notes to acquire additional bitcoins.

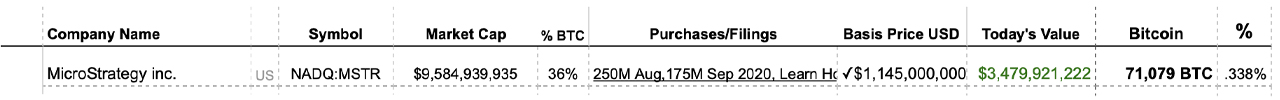

Microstrategy has purchased a great number of bitcoins and currently holds 71,079 BTC worth more than $3 billion using today’s exchange rates. The move to sell convertible notes is not unusual for the intelligence company as Microstrategy completed a $650 million capital raise to purchase bitcoins in mid-December.

While Michael Saylor tweeted the latest announcement, bitcoin (BTC) prices were in the midst of reaching a new all-time high (ATH) on Tuesday morning. BTC shot up to $50,603 per coin on February 16, 2021, and has a market cap valued at over $900 billion today.

Following Saylor’s tweet, Michael Sonnenshein the CEO of Grayscale responded to the recent Microstrategy move. “Trying to catch up with Grayscale?” Sonnenshein asked, as the CEO’s Grayscale Bitcoin Trust holds a whopping 649,130 BTC worth $31 billion today.

A few other people responded to Saylor’s tweet with criticism and said: “Dude is full knowingly creating the biggest bubble in history, fu**ing legend.” The comment was blasted by a person who disagreed with the “biggest bubble” statement.

”If you think it’s a bubble you don’t get it, we are bursting the fiat bubble,” the individual said.

Digital Gold

Microstrategy and Michael Saylor have been relentlessly pushing the digital gold narrative and Saylor has said that the popular yellow precious metal gold is antiquated.

“If institutions want to move billion-dollar blocks of money around the globe, gold is a million times more expensive than bitcoin,” Saylor said. “And a thousand times slower. We can’t build a modern economy on antiquated technology,” the Microstrategy executive added.

Many people support Saylor’s perspective that BTC can be digital gold, a store of value, and something that offers investors long-term potential growth. “The narrative of bitcoin becoming the digital gold is gaining traction,” John Wu, the president of Ava Labs told news.Bitcoin.com on Tuesday.

“If that narrative comes to fruition, then the growth potential is off the charts as $50,000 per BTC equates to a market cap of roughly $931B, which is almost 9% of Gold at roughly $10.6T market cap,” Wu said.

The AVA Labs president further added:

If BTC meets Gold’s market cap, then that would be at least $500,000 per BTC.

With 71,079 bitcoin on hand and more to come after selling the convertible notes, Microstrategy will be a publicly listed company with almost as much bitcoin as one of the top BTC hedge funds. Shares of Microstrategy (Nasdaq: MSTR) dropped over 2%, after the CEO announced the company would be selling the notes for bitcoin.

What do you think about Microstrategy selling convertible notes to purchase more bitcoin? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, bitcointreasuries.org

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link